Data Collection

CollectionCollection of most accurate andstatistically significant data verified by 10+ sources.

- Property registration data from government

- Listings on various property portals

Analysis

Trends analysis with cycles and anomalies.

Secondary research on urban planning master plans coupled with government infra push.

Investment Thesis

Personalized investment thesis for each client for risk mitigation coupled with IRR maximization using ML models.

Analysis for alpha determination in comparison with investment in different asset class.

PIYUSH GUPTA

Piyush’s 12 years career spans across entrepreneurship, consulting and investment management. In his last role, Piyush was leading investments for a micro-cap VC fund Lykke Capital. During career, he has built deep understanding of diverse sectors such as retail, consumer, infra etc.

Prior to that he started a strategy consulting firm and took exit from it after running for 5 years. He has done MBA ISB, where was the Merit’s Scholar

MOHIT SAXENA

Mohit has 8 years of experience in real estate investmentadvisory. In his last role, Mohit was leading investment advisoryfor Gurgaon for Square Yards. During his career, he has workedwith developers in both Tier-1 and Tier-2 markets and built adeep understanding of investment analysis and cycles within realestate sector. He has done BE from Bangalore University.

Why invest inReal Estate?

Indian Real Estate is poised to grow from USD 300 Bn in 2024 to USD 1.3 Tn in 2034 and USD 5.2 Tn in 2047 which makes it the fastest growing sector to contribute to India’s GDP gowth.

Real estate provides portfolio diversification with higher returns and low volatility.

Rental income forms a significant portion of returns (30-40% in commercial realestate, ~15% in residential real estate) making real estate a good passive income stream

Why invest with Insight Capital

We create personalized risk-reward analysis for each client taking into account factors such as investment time-frame, risk appetite and combine it with our ML models to arrive at Asset Identification

Our deep relations with PAN-India developers help in getting exclusive inventory and discounted pricing along personalized payment plans for our customers. in-house legal team helps customers contract understanding agreements.

We believe our relations with clients do not end investments. provide personalized strategy for exit timings to realize returns.

Navigating Real Estate Investment

Understanding SCO developments in Gurgaon

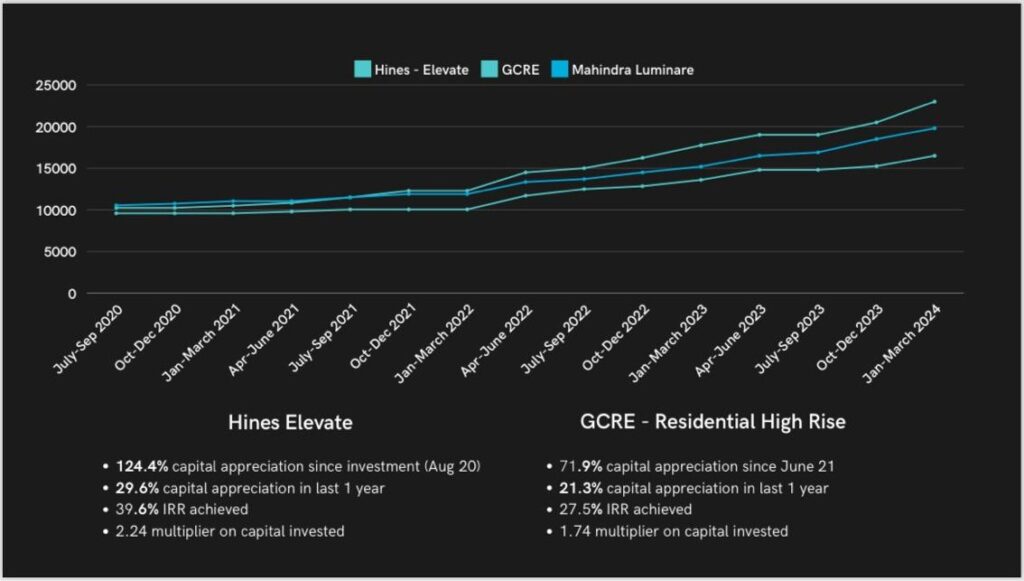

Investment in Hines Elevate

Location Tailwinds

Urban planning for GCRE - residential, retail, office land demarcation & connectivity including metros - is better than Golf Course/MG road as per

Gurgaon development master plan 2031 making Gold course extension road poised for massive growth.

Project Advantages

First project in Gurugram with European style architecture and more than 70% green area in the premises. The payment plan of the project made it attractive

to invest in the project.

Diligence Findings and Growth Outlook

Project was first foray by Hines (US based developer) in residential real estate Gurugram. Developer had previously delivered a commercial project - One Horizon JV with DLF. We projected return of ~27% compounded at the time investment horizon 5 years.

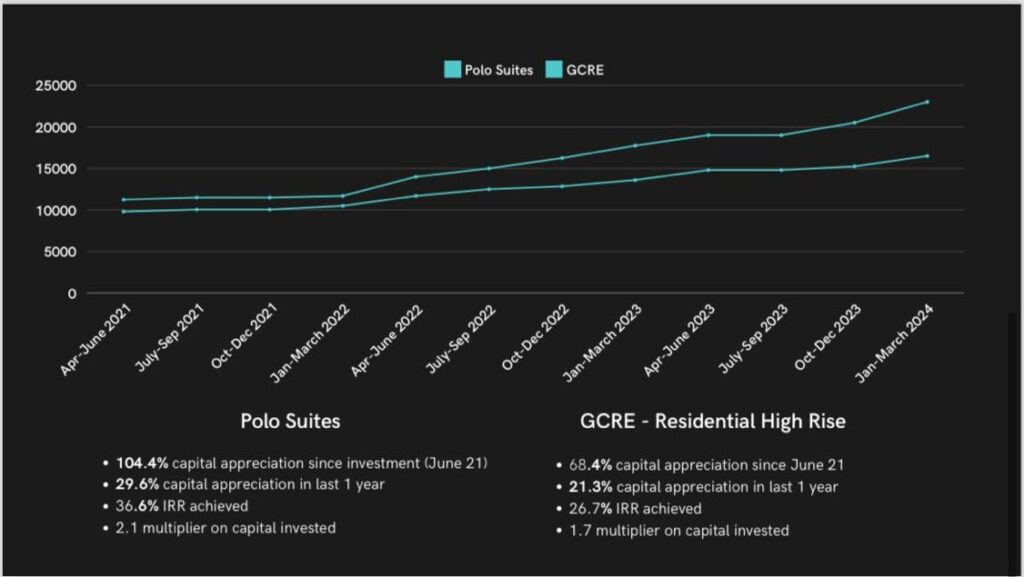

Investment in Polo Suites

Location Tailwinds

Urban planning for GCRE - residential, retail, office land demarcation & connectivity including metros - is better than Golf Course/MG road as per Gurgaon development master plan 2031 making Golf Course Extension Road poised for massive growth.

Project Advantages

The project was first ultra-luxury project launched on GCRE coupled with bigger size (3000 sqft - 7000 sqft) apartments. Additionally, the concept of the project was good which included low density (<60 apartments per acre), a 9 hole golf course and the biggest clubhouse amongst all luxury residential project at the time of project launch.

Diligence Findings and Growth Outlook

The project was developer’s first foray in ultra-luxury segment which made delivering a high-quality project extremely important for the developer. Additionally, developer had more than 2600 acres land bank in Gurugram mitigating the risk of default and incomplete project. We projected a return of 24% at the time of investment with investment horizon of 4 years.